Russian Anonymous Marketplace (RAMP) is a prominent dark web forum that quickly became significant within the cybercriminal community. Established as a successor to several earlier dark web marketplaces, RAMP focuses on providing a secure platform for trading a wide range of illegal goods and services, including drugs, digital goods, and hacking tools. The forum’s emphasis on anonymity and security has made it a popular destination for cybercriminals.

Antivirus Software

These APIs can be vulnerable to attacks, such as JavaScript injection or the rerouting of data, if not incorporated with the appropriate security. To protect against many of these attacks, eCommerce sites can use a combination of Transport Layer Security (TLS) encryption and strong authentication and authorization mechanisms, like those offered by OAuth and OpenID. Device fingerprintingFingerprinting is done by combining the user’s browser and device to understand who or what is connecting to the service.

- The forums also offer tutorials and guides on new hacking techniques as well as ways of improving existing skills.

- These platforms continuously scour the deep and dark web, looking for any traces of your sensitive information.

- Alongside the obvious sensitive data pertaining to the cards, the dump includes personal information as well, including email addresses, phone numbers, and the address of the card holder.

- These measures include encrypted connections, two-factor authentication, and strict registration processes to prevent infiltration by law enforcement agencies or rival hacking groups.

- Dark web posts and offers of this size are usually scams, so the massive dump of cards could easily be fake data or recycled data from old dumps repackaged under a new name.

Efficient Threat Intelligence Gathering:

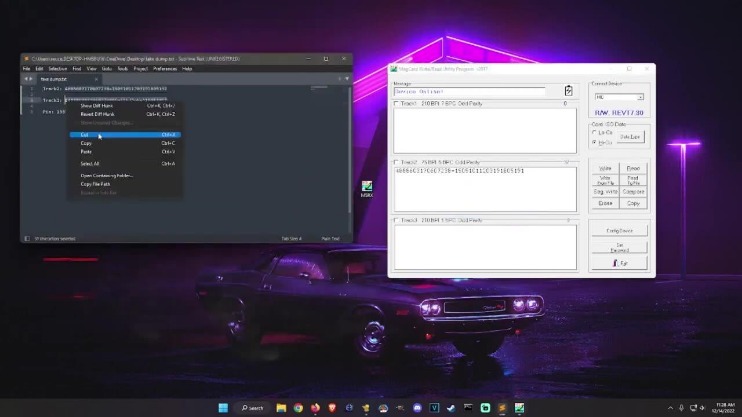

The ability to emulate NFC cards dynamicallymay enable physical security bypass or unauthorized access inreal-world environments. Theidentified Telegram channels provide detailed manuals on how to useZ-NFC for fraud. The bad actors created intuitive videos guidingcybercriminals on defrauding consumers and using compromised paymentdata via NFC. Primarily, the actors use Android-based phones, with numerous cards “loaded” into mobile wallets for further fraud. In one such instance, cybercriminals specifically focused on fraud automation against Barclays, Lloyds, Halifax, HSBC, WISE, Santander, Bank of Scotland, and Revolut. API securityeCommerce sites often use credit card APIs, such as those offered by PayPal or Square, to facilitate transactions.

How Do Criminals Get Credit Card Information

Carding is a type of scam that begins with cyber criminals obtaining payment-card details in various ways. Prevention tools include CAPTCHA, velocity checks, IP blacklisting and geofencing as well as device fingerprinting. AI-driven fraud platforms can also help detect bot activity and assess transaction risk in real time. Monitoring for compromised credentials or leaked customer data on the dark web is also essential.

Greater Use Of Advanced Tools And Services

For instance, BidenCash saw a surge in user activity following its free data leaks. New entrants, however, have so far largely struggled to obtain a loyal customer base – most likely due to a significant loss of trust by remaining buyers. Chatter on stolen data forums makes this sentiment all too clear; consumers are quick to label new vendors a ‘scam’ and suspect foul play as soon as their deposit arrives mere moments too late. Accessing them may require .onion links and the Tor browser, but caution is advised due to legality and cybersecurity risks. Classic darknet markets sell diverse illegal goods; data stores focus on leaked or stolen data like credentials, databases, and ID records. While some of these markets were shuttered by law enforcement agencies – some took the easy way out with exit scams.

Carding has far-reaching consequences for individuals, financial institutions, and the global economy. Victims of carding often suffer financial losses, compromised personal information, and damaged credit scores. Financial institutions face significant financial burdens, as they must reimburse victims and invest in enhanced security measures. Moreover, the overall trust in online transactions is undermined, hindering the growth of e-commerce. These aren’t just random forums, they’re organized platforms where stolen card data gets packaged and sold as “fullz” (full card details including CVV) or “dumps” (raw magnetic stripe data).

Some are looking for illegal stuff they can’t buy elsewhere, like drugs or counterfeit documents. The impact of dark web credit card fraud extends far beyond individual card holders. Some threat actors even run automated validation services that check card numbers before the sale, guaranteeing their buyers a certain percentage of “live” cards.

Responsibility Of Businesses To Prevent Carding

These platforms provide a marketplace for payment card data stolen by a variety of actors, leading to further specialization in crime. The dark web has become a haven for illicit activities, with carding being one of the most significant threats to the global financial system. Carding refers to the unauthorized use of credit or debit card information to make purchases or withdraw cash.

Fraudulent actors would steal wallets or purses to gain access to credit cards, or place devices on ATMs or POS terminals that captured card information during swipes. The process of carding begins with card thieves, known as “carders,” who steal credit card information through phishing, skimming, conducting data breaches, or keylogging. This need to learn how to operate/build sniffers or build relationships with sniffer/skimmer operators has lessened the appeal of carding. Obtaining card details with sniffing or skimming tools is no simple matter—to go down this route, a cyber criminal has to find a way of installing their scraping tool on the target, whether it’s digitally or physically.

Tips And Advice For Protecting Yourself From Carding Attacks

Governments worldwide are enacting laws and regulations to combat cybercrime, including carding. Familiarize yourself with the cybercrime laws in your country and support initiatives that aim to enhance online security. Strengthen cooperation between law enforcement agencies and technology companies to trace and shut down carding sites.

The Anatomy Of NFC-based Carding

Despite all the attacks, blocks, and the constant pressure from the authorities, the forum remains active. Not only do cybercriminals use it, but Dread has also become a go-to source for cybersecurity professionals to spot emerging threats, track criminal groups, and even understand the trends in the dark web market. To help avoid carding, use reliable anti-malware software to detect malware that could compromise your security, and ensure that your operating system and other software are kept up to date. Additionally, set up credit card notifications to track transactions in real time, helping you catch any unauthorized activity quickly.

Dark web community channels are always evolving to ensure that they evade law enforcement agencies. That’s why the cybercriminals use these forums, as they know that they’re there to stay. Tor offers secure and encrypted access to the dark web forums, ensuring that the user’s IP address is hidden and difficult to trace.

Curious About How Breachsense Can Help Your Organization Detect Credit Card Fraud? Book A Demo To Learn More

Governments and regulatory bodies will continue to tighten security requirements and compliance standards, compelling financial institutions to adopt more robust fraud prevention frameworks. Stricter regulations surrounding data privacy, customer authentication, and incident reporting are likely, particularly in regions like the United States and the European Union. Increased international cooperation between law enforcement agencies will become essential, targeting global criminal networks through coordinated actions and intelligence sharing. Many banks now offer virtual credit cards—temporary digital card numbers linked to your primary account. Use virtual cards for online shopping, as these numbers are single-use or short-term, limiting potential exposure if compromised. The widespread adoption of EMV chip technology—embedded microchips in credit cards—has substantially reduced fraud related to counterfeit physical cards.

By shedding light on these hidden online networks, you will better understand the threats that exist in cyberspace and how proactive awareness can significantly reduce personal and collective risk. In2020, students at the Technical University of Darmstadt, Germany,developed NFCgate to capture, analyze, or alter NFC traffic. The “Ghost Tap” technique enablescybercriminals to cash out money from stolen credit cards linked tomobile payment services such as Google Pay or Apple Pay by relayingNFC traffic via NFC-enabled POS terminals. In this case, bad actors”tap” their mobile devices with stolen, compromised data tomake fraudulent transactions.