I’ve seen cases where security teams identified compromised card data from their institution appearing on the dark web weeks before they traced the actual breach point. The key is catching this activity before large volumes of card data make it to market. What many don’t realize is that much of this stolen data comes from large-scale breaches rather than individual card skimming.

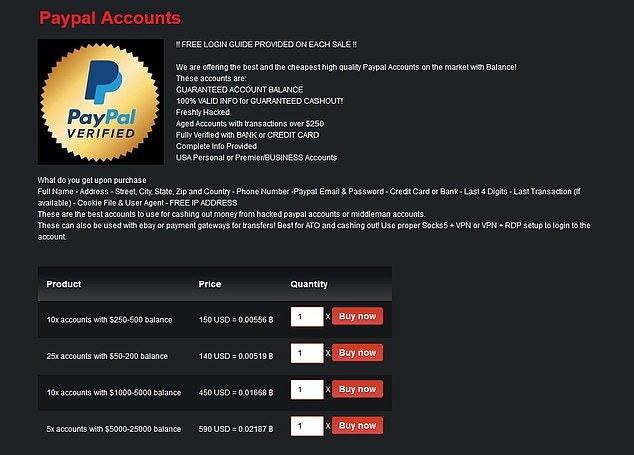

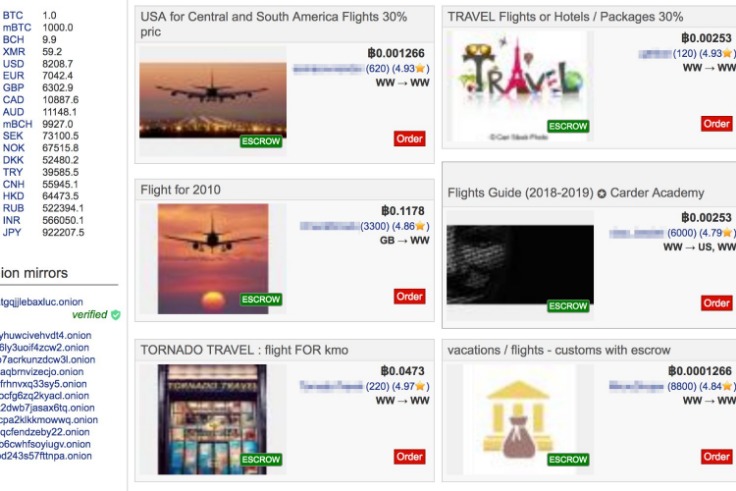

Under the Fair Credit Billing Act, your liability for credit card fraud is just $50 if reported within 60 days of the charge. All major credit card networks including Visa, Mastercard, Discover, and American Express offer $0 liability. Carding shops are a type of dark web marketplace that hosts the trade of credit cards and other stolen financial information. These platforms serve as hubs for cybercriminals to buy and sell compromised payment card details.

Financial Losses

Research and financial considerations may influence how brands are displayed. These bundles of personal info are called “fullz“, short for “full credentials.” So instead of looking at the prices of SSNs on their own, Comparitech researchers analyzed the prices of fullz. All content provided on Web Design Booth is for informational purposes only and does not constitute professional advice. We strive for accuracy and authority, but it is recommended to consult with qualified professionals before making decisions based on our content. Web Design Booth may receive compensation from third-party advertisers, which does not influence our editorial content. Abraham Lebsack is a seasoned writer with a keen interest in finance and insurance.

Is It Illegal To Access The Dark Web?

Unless you live the rest of your life only paying with cash, you’ll never be totally impervious to payment fraud. Some fullz even include photos or scans of identification cards, such as a passport or driver’s license. This extra layer of security gives peace of mind in today’s digital world. With just a few taps, people can see exactly where their money goes and catch problems early.

In the message, you will be asked to click on a link and enter your credit card details, which the scammer will then capture. No, purchasing stolen credit card information is illegal and can lead to criminal charges. The Google hacks, popularly known as Google dorks for credit card details,48 are also used often in obtaining credit card details. Two other states had indictments for Roman Seleznev and wanted to try him, too. Remember how it was really suspicious that Roman, or Track2, was a trusted vendor on Carder.su the day he opened an account? Yeah, some feds in Las Vegas thought this was suspicious enough and accused Roman of being the owner of Carder.su.

Fraudsters can use the stolen information for unauthorized transactions, identity theft, or resell the data on other platforms. The scale of this leak underscores the persistent vulnerabilities in global payment systems. This incident is described as one of the largest giveaways of compromised credit card data in recent history. Most banks and credit card vendors offer you the option to receive fraud alert notifications—email or text alerts—warning you of potential card theft.

The sale of payment card information is big business; in 2022, the average price of stolen credit card data averaged between $17 and $120, depending upon the account’s balance. Card data is a hot commodity on the dark web, with credit card details and cloned cards being sold to cybercriminals. These stolen cards can be used for financial gain through unauthorized charges, account takeover, and identity theft. So, if you are curious about the mechanics of the Dark Web and how credit card transactions take place in this hidden realm, read on to discover the secrets of this nefarious underworld.

Using Tracker Apps To Monitor Your Card Data

Learn to fetch data, analyze content, and generate reports automatically. If so, this guide will help you automate supply chain risk reports using AI Chat GPT and our News API.

- The first step you should take is to contact your bank or credit card issuer immediately.

- The more secure your information is, the less likely it will be to fall into the hands of a threat actor.

- By regularly checking your credit reports and statements, you can quickly identify any unauthorized charges or suspicious activity.

- No matter how vigilant you are, there is nothing you can do to prevent a data breach on a merchant’s website, but using a virtual card can shield your actual card data from being exposed.

- Unlike online fraud, this type of theft is harder to detect because the transaction appears as a regular swipe.

- If we compare the amount found to the reported market share by brand, we can immediately notice a correlation, there seems to be no discrimination of brands sold on the dark web.

Contact Your Bank Or Credit Card Issuer

Whether you choose to work with a financial advisor and develop a financial strategy or invest online, J.P. Judging from the activity on the shop, BidenCash appears to be thriving in 2023, providing an active data and money exchange platform in a market that has experienced a decline in recent years. In addition to the risk for payment card holders, the leaked set could also be used in scams or other attacks targeting bank employees. This time, the leaked data contains card numbers, expiration dates, and three-digit security codes (CVVs). The expiration for most cards reviewed by BleepingComputer ranges from 2025 to 2029, but we also spotted a few expired entries from 2023. Learn how to automate financial risk reports using AI and news data with this guide for product managers, featuring tools from Webz.io and OpenAI.

Physical Theft

- Illegal activities thrive on the dark web, including the illicit trade and sale of credit card information.

- These platforms sell everything from drugs and fake IDs to weapons and hacking tools, resembling a digital black-market bazaar.

- Be cautious when making online transactions, especially when it comes to sharing credit card information on the dark web.

- He chooses one, stamps the number and information onto a blank card, and uses that card to make payments, often using the stolen payment information to buy goods, like gaming systems, and sell those as well.

- In 2019, there were approximately 8,400 active sites on the dark web, selling thousands of products and services daily.

It can take months—or even years—to recover from this kind of identity fraud. UniCC has been active since 2013 with tens of thousands of new stolen credit cards listed for sale on the market each day. If your credit card information is compromised, report it immediately to your bank, monitor your accounts for suspicious activity, and consider using a credit monitoring service.

Exploring Benefits And Risks Of Using Credit Cards Or Card

This veil of secrecy makes it an attractive haven for illegal activities. This post will discuss deep and dark web credit card sites, specifically the top illicit credit card shops. As one of the prominent platforms supporting such activities, card shops make carrying out such scams relatively easy and popular.

How Breachsense Can Help With Dark Web Monitoring

Humans, being the slaves of habit, are more inclined to use the same kinds of passwords for most of their accounts. Instead, one must create strong and unique passwords using a password manager. Especially for your banks or financial accounts, the passwords must be strong and unique to that account only. Hacking in cyber security refers to the misuse of devices like computers, smartphones, tablets, and networks to cause damage to the systems. After hacking a device, cybercriminals can steal any information on users. If your credit card number or other details are detected on the dark web, you will be immediately alerted, allowing you to take protective measures.

MOMENTUM MARKETS NETWORK

Criminals in these cases will attempt to secure the ransom payment after data has already been stolen and put up for sale on the dark web, according to Mr Foss. Free VPNs are often not trustworthy and could put your online privacy and security more at risk. It would help if you used a paid VPN from a reputable provider to ensure the best protection for your credit card information. Skimming refers to stealing credit card information from physical cards. The cybercriminal installs a small device, known as a “skimmer,” on credit card reachers, such as the ones you see at retail stores, ATMs, or gas stations. The installed device reads the magnetic stripe on the card with the cardholder’s information and sends it to the cybercriminal.

Cybercriminals exploit vulnerabilities in payment systems, compromising credit card details. Once obtained, this information is used for identity theft, fraudulent purchases, and money laundering. Once obtained, these stolen credit cards are quickly sold on the dark web, where they can be used for fraudulent transactions or identity theft. Protecting your credit card information is crucial to avoid financial loss and potential legal troubles.